Haute Market

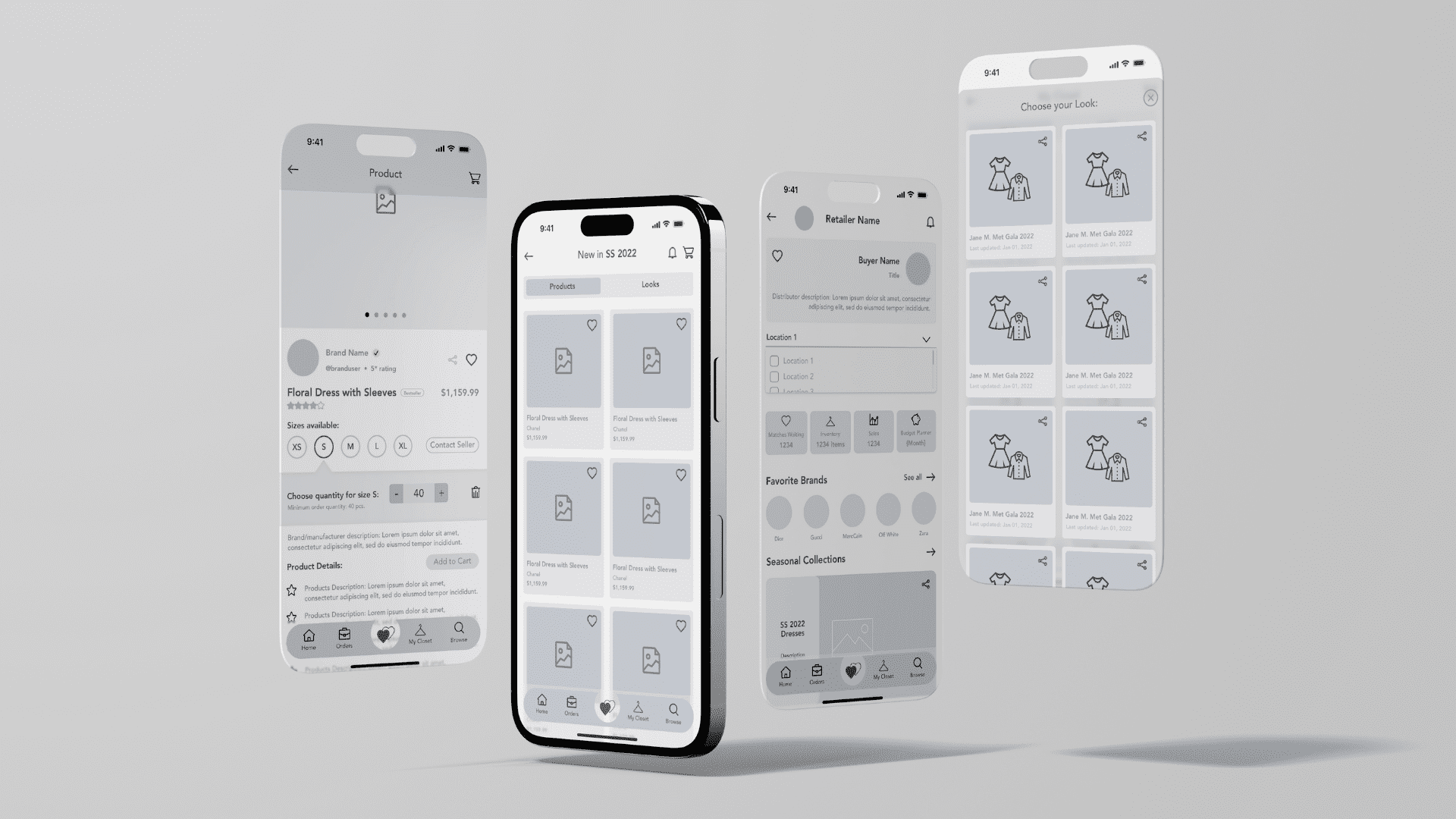

About Industry: Fashion & E-commerce Haute Market, a trailblazing virtual matchmaker, endeavors to reshape the realm of fashion and home goods by connecting retail buyers

A collection of case studies by GEM and our partners. See what GlobalEdgeMarkets can do for your business. We’ve helped companies worldwide improve their businesses to help them enter new markets seamlessly.

In our case studies, you’ll learn about how our solutions to common business issues have led organizations towards success.

About Industry: Fashion & E-commerce Haute Market, a trailblazing virtual matchmaker, endeavors to reshape the realm of fashion and home goods by connecting retail buyers

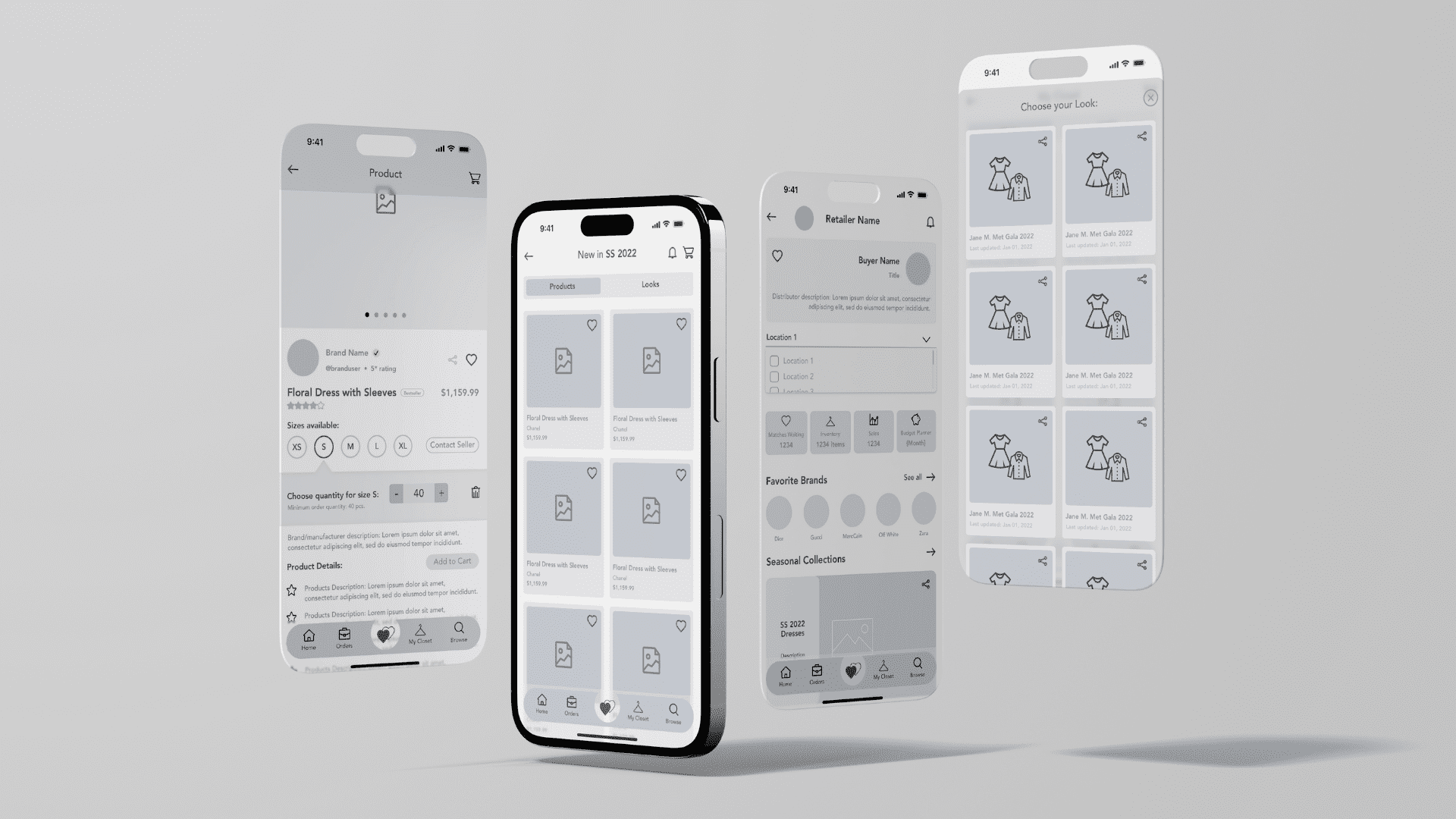

About Industry: Healthcare Wendy’s Team is helmed by Dr. Wendy Tong, a passionate advocate for elderly care and a seasoned expert in the healthcare industry.

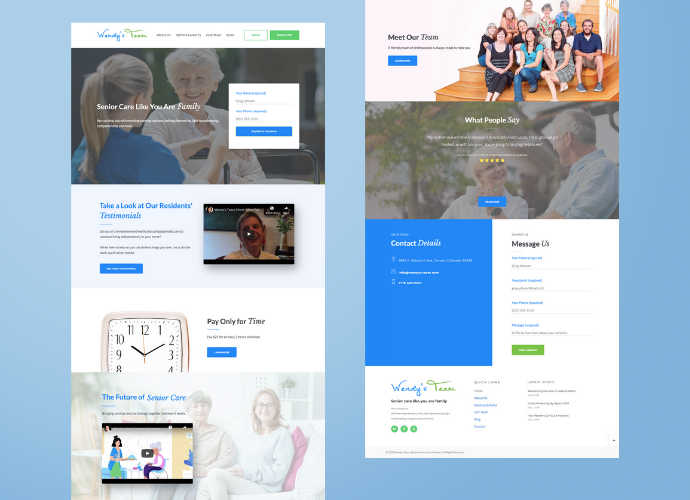

About Industry: Healthcare & Software Dedicated to the healthcare and HealthTech sectors, The Caregiving Network™, under the leadership of founders Al Farmer and Andy Cramer,

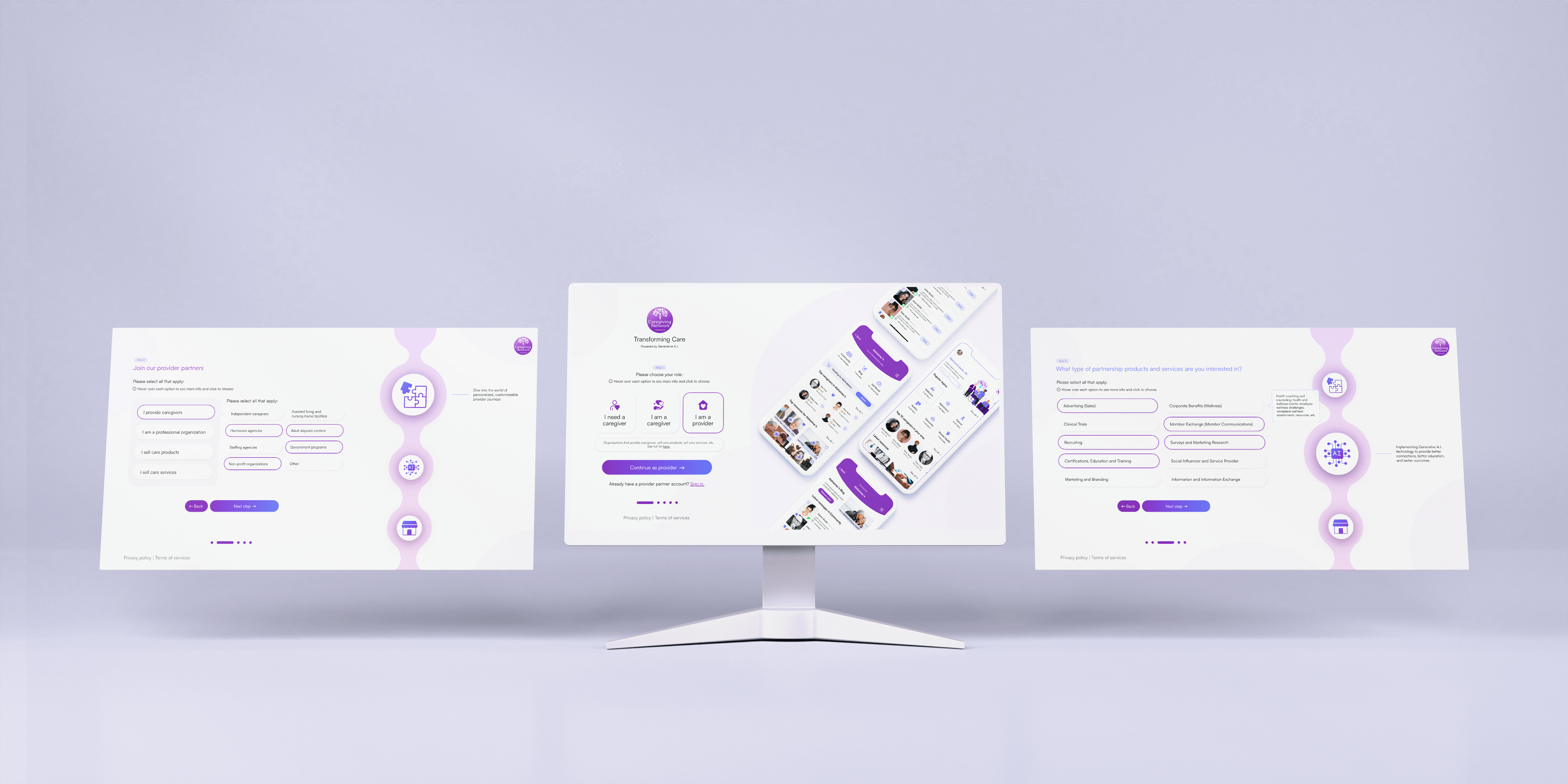

About Industry: Software, HealthTech In the rapidly evolving world of HealthTech, being proactive and nimble is essential. Demigos, under the leadership of Ivan Dunskiy, CEO

About Industry: Lifestyle & Beauty Beautyfix MedSpa is a leading cosmetic medical surgery centre with multiple locations in New York, Westchester, and the Hamptons. The

About Industry: Lifestyle & Beauty Manhattan MedSpa is a leading medical spa located in Manhattan, New York, that offers state-of-the-art technology treatments and the best products

About Industry: Lifestyle & Beauty Genlyft and its family of procedures, including GenBody, is the brainchild of creator Dr. William Boss, a pioneer of laser

About Industry: Travel Panorama Travel is a full-service travel company that has been operating since 1990, helping travelers around the world make their vacation dreams

About Industry: Logistics Truxx.ai is a technology company that offers a personalized, integrated trucking business management platform for truckers and owners. Founded in 2022, Truxx.ai

About Industry: Recruiting Since 2000, reesmarxGLOBAL has operated as a boutique recruitment agency, placing talented leadership and executives across all disciplines worldwide. Their experienced and

About A professional offline and online peer network of top Chief Marketing Officers (CMOs). It is a leadership community for Chief Marketing Officers that hosts

About PondMobile, a global MVNO (Mobile Virtual Network Operator), initially engaged Social2B to better manage social media channels. And with the rise of Instagram (prior

Through decades of experience, our experts have developed strategies and techniques that are proven to bring success to customers worldwide.

Whether we are helping launch a new digital logistics platform or assisting to set up a Global HQ utilizing local, regional, and global resources, we pride ourselves in knowing the next steps to achievement, innovation, and optimization, and sharing them with our partners and clients.

We create and curate the best content on entrepreneurship, technology & innovation.

Fill out the form on our contact page and we’ll contact you as soon as possible!

©2023 GlobalEdgeMarkets Social2B Media Holdings, L.L.C.

All Rights Reserved.

Privacy Policy